All topics

ESG Allocations in Light of the UN's Water Conference

What can investors do to create a better world?

With the United Nations' Water Conference at the top of ESG investors' agendas, this collection of insights offers investors further reasons to consider sustainable principles. The research is particularly important today when ESG sceptics are growing in number.

Five ESG Themes In Fixed Income For The Year and Years Ahead (Man Group)

Looking ahead, ESG investing will continue to mature as regulation and scrutiny from investors becomes more intense. This bodes well for the sector.

To Be Sustainable, Businesses Need Cybersecurity (American Century Investments)

ESG allocators need to focus on cybersecurity. This risk affects sustainability in ways that extend beyond data hacks to actual physical assets.

A Survey on ESG: Investors, Institutions and Firms (Cambridge University)

Existing ESG measurements are subject to considerable disagreement among ESG data providers. This is perhaps a reason for rising scepticism.

Climate Transition For Credit Investors (Allspring Global Investments)

For compliance reasons, this paper is only accessible in certain geographies

Although green bonds represent less than 5% of the global bond market, they are far easier to be identified as appropriate for a decarbonising portfolio.

The Sustainable Bond Market Of Urban GSS Bonds (Franklin Templeton Investments)

For compliance reasons, this paper is only accessible in the EMEA region

Exposure to Green, Social and Sustainability (GSS) bonds at country level typically allows for financing of large-scale strategic infrastructure, such as water projects.

Green Bond Pricing in the Primary Market: H2 2022 (Climate Bonds Initiative)

By mid-January 2023, US$204.5bn worth of green bonds priced in H2 2022 had been added to the Climate Bonds Green Bond Database (GBDB).

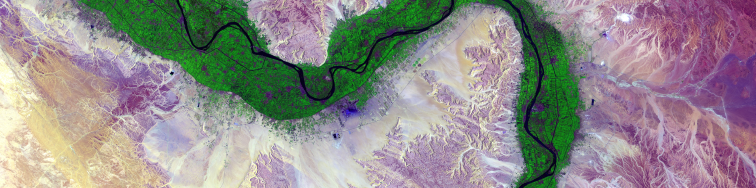

Universal Access To Clean Water And Sanitation (BNP Paribas AM)

Water stress is growing across all continents. Poor infrastructure contributes to water stress and could represent an opportunity for investors.

SPECIAL REPORT

Portfolio Risk and the ESG Effect: Pulling back the veil (Special Report, 2023)

For compliance reasons, this paper is only accessible in certain geographies

Northern Trust Asset Management’s latest ‘Risk Report – ESG Special Edition’ is an important contribution to the ESG conversation, as it reveals fascinating insights into the impact of ESG exposure to portfolio risk.